Despite efforts by the state’s Department of Insurance (DOI) to revise

the rate making policies in California, on March 20, State Farm

announced it would not be renewing more than 70,000 commercial,

residential and rental insurance policies in California. And the

announcement emphasized that these actions were only being taken in

California.

Less than a year ago, State Farm announced it would not be writing any

new policies in California. At least seven other insurance carriers,

including Allstate and Farmers Insurance, announced similar intentions.

State Farm tried to explain its reasons in the statement, “This decision

was not made lightly and only after careful analysis of State Farm

General’s financial health, which continues to be impacted by inflation,

catastrophe exposure, reinsurance costs, and the limitations of working

within decades-old insurance regulations … It is necessary to take these

actions now.”

Although the company acknowledged the actions the DOI has taken in the

past several months and its future intentions, State Farm nevertheless

felt compelled to reduce its coverage in California.

In 2023, the Insurance Information Institute highlighted the industry’s

problems with the wildfire insurance situation in California.

“California’s difficulties are not just due to the types of perils the

state faces. Proposition 103, a three-decades-old legal measure,

constrains insurers’ ability to accurately underwrite and price these

risks. Insurers must be able to set premium rates prospectively, and

Proposition 103 bars them from doing so. Instead, it requires them to

price coverage based on historical data alone. It also prohibits them

from including reinsurance costs into their pricing …”

The threat of a catastrophic wildfire has grown. Dry winters, along with

hotter summers, exacerbate this threat. In California, insurance

companies must base their rates on historic losses, not potential

threats nor increasing costs to rebuild the structural losses.

While the Legislature was unable to agree upon any insurance reform

legislation before it adjourned in Sept. 2023, Gov. Gavin Newsom

encouraged Insurance Commissioner Richard Lara to begin making

administrative changes to encourage insurance companies to remain in

California and begin to expand their underwriting.

On Sept. 21, 2023, Newsom issued an executive order requesting that the

insurance commissioner “… take prompt regulatory action to strengthen

and stabilize California's marketplace for homeowners’ insurance and

commercial property insurance …”

And he specified five goals, the first of which was to expand the fire

insurance choices for homeowners, especially in vulnerable areas. Among

the other four, Newsom wanted to improve DOI’s rate approval process

and, importantly, maintain the solvency of the FAIR Plan.

In September, Lara announced his Sustainable Insurance Strategy. Among

the problems the plan was to address were the changing climate

conditions, inflation, the 30-year-old regulatory process and the FAIR

Plan.

Lara hoped to achieve greater policy availability, reduce the number of

homeowners relying on FAIR, and increase coverage in wildfire-threatened

areas.

In the six months since then, Lara has made modifications in the FAIR

Plan and proposed new regulations for streamlining and clarifying the

rate-making process and allowing future rate requests to be based on

modeling forecasts of calamities as well as cost increases rather than

just relying on historical data.

One of Lara’s first changes, which the state courts approved in

November, affected the coverage of FAIR Plan policies. The California

FAIR Plan is an insurer of last resort. It is required to accept any

property regardless of its wildfire exposure. It is neither a state

agency nor funded by any state or public taxes. Its funding primarily

comes from the policies it sells to customers.

In 2023, the FAIR Plan had 350,000 policies in force, an increase of

23%, Victoria Roach, president of California’s FAIR Plan, told the

Assembly’s Insurance Committee. It is now receiving 1,000 requests for

new policies daily.

“The FAIR Plan covers a significantly higher concentration of high

fire-risk properties than voluntary insurers. Its total risk exposure

was over $311 billion as of December 2023 compared to $50 billion in

2018,” Roach added.

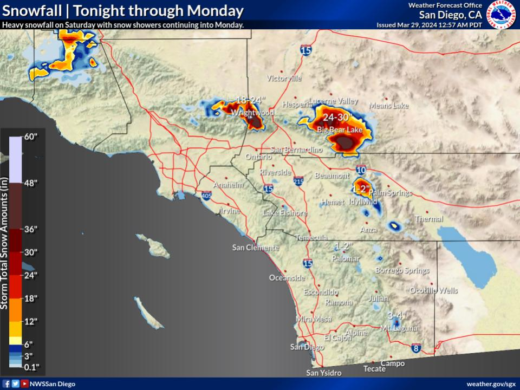

In Southern California, its largest exposures are near Lake Arrowhead

and Big Bear.

The proposed change required broader coverage for FAIR Plan policy

holders, rather than the “bare bones” of only fire and smoke damage.

This limitation required policy owners to seek added insurance for

possible liability or water damage.

A Los Angeles Superior Court Judge upheld Lara’s authority to order more

coverages, including accidental discharge or overflow of water or steam;

premises liability; incidental workers’ compensation; theft; falling

objects; weight of ice, snow or sleet; freezing; and loss of use,

including coverage for added living expenses and fair rental value.

These are typically included in a standard comprehensive homeowners’

policy, but not offered under the FAIR Plan’s limited fire policy.

The bigger issue of changing the rate-setting process was not being

delayed. Lara issued new regulations for the rate-making process in

February. A month later, he issued draft regulations to incorporate

using catastrophe modeling into consideration of rate levels.

On Feb. 9, the DOI published draft regulations intended to modernize the

submission requirements for auto, home, business, and other property and

casualty insurance for new rate request applications. The DOI noted that

the current regulations were “created in an age of pagers and

payphones.”

“My proposed regulations represent a crucial step towards fostering a

fair, transparent, and efficient rate approval process,” stated Lara in

the accompanying news release. “By updating submission procedures and

clarifying requirements for insurance companies, we aim to eliminate

confusion, reduce delays, and enhance public participation in the

rate-making process. This will help our Department’s experts make sure

that no policyholder is paying more than is required.”

These changes are intended to clarify future submission documents,

eliminate debate about incomplete applications, and specify the

necessary data to evaluate a rate change.

Five weeks later, Lara released a regulation allowing and specifying the

use of catastrophe modeling for wildfire, terrorism and flood lines. DOI

already permits using this modeling for earthquake losses and fire

following an earthquake. Current rate provisions are based on historical

data. This does not permit the companies to use models that can help

predict wildfires and where they may occur.

“Under outdated rules, the growth of climate-driven mega fires has

supercharged insurance costs for many Californians while making

insurance harder to find,” Lara said in the news release about

catastrophe modeling. “We can no longer look solely to the past as a

guide to the future. My strategy will help modernize our marketplace …”

The goals of this second set of regulatory revisions are more reliable

rates and greater availability of insurance policies.

However, Consumer Watchdog is concerned with how this new rule will be

implemented and the public’s ability to review the data and model.

“Black box catastrophe models are notoriously contradictory and

unreliable, which is why public review and transparency are key before

insurance companies are allowed to use them to raise rates,” Consumer

Watchdog stated in its news release. “Commissioner Lara’s proposed rule

appears drafted to limit the information available to the public about

the impact of models on rates in violation of Proposition 103.

“The rule fails to spell out whether or how the Department of Insurance

would assess a model’s bias, accuracy, or the validity of the science,

instead creating a pre-review process that appears primarily focused on

determining what information companies must disclose and what they may

conceal from public view.”

Besides modeling how climate changes may be affecting the frequency and

occurrence of wildfires, this set of regulations also incorporates the

actions of homeowners and communities to mitigate the threat of

wildfires in or near their communities. This is consistent with the

DOI’s requirement for “wildfire safety discounts” as the result of

mitigation projects.

Amy Bach of United Policyholders recognizes the discouraging state of

California’s wildfire insurance market. But she expressed optimism that

it will improve.

However, she did advise homeowners who received a nonrenewal notice to

begin shopping for another policy. “Dig for policies, be patient.

Insurers are still in the CA market but with strict limits and quotas on

how many policies they’ll sell in given areas.”

In February, before the announcement of plans to curtail some coverage

in California, State Farm announced its 2023 financial results. For the

property and casualty piece of the firm, last year was worse than 2022.

“The State Farm P-C group of companies reported earned premium of $87.6

billion and a combined underwriting loss of $14.1 billion. This result

compared to an underwriting loss of $13.2 billion on earned premium of

$74.3 billion in 2022. The change over 2022 reflects improvement in auto

lines underwriting results which was offset by the significant increase

in homeowners incurred catastrophe claims,” as reported in the company’s

financial news release.

State Farms’ nonrenewals of some policies will occur on a rolling basis

over the rest of this year, beginning July 3, for homeowners, rental

dwellings, residential community associations and business owners. On

Aug. 20, commercial apartment policies will cease to be renewed.

Combined, these policies represent just over 2% of State Farm General’s

policy count in California.