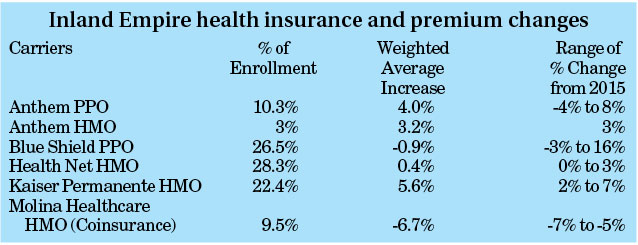

Last week, Covered California announced its rates for health insurance for 2016. Statewide the average increase was 4 percent, slightly lower than the 4.2 percent increase for 2015. In the Inland Empire region, which is Riverside and San Bernardino counties, the average increase will be only 1 percent.

The lowest-priced bronze plan will increase 3.3 percent and the lowest priced silver plan increases only 1.5 percent statewide, but locally, the premium of the lowest-priced bronze plan declines 7 percent and the lowest-priced silver plan falls 6.3 percent.

Many Covered California consumers will see either a decrease in their health-insurance premiums or an increase of less than 5 percent if they choose to keep their current plan. Also, consumers can reduce their premiums by an average of 4.5 percent if they shop among the various plans and change to a lower-cost plan within the same metal tier, according to Covered California’s press release.

“Covered California is holding the line on rates and keeping coverage within reach of hundreds of thousands of consumers, while giving them more choices than ever before,” said Covered California Executive Director Peter V. Lee in the release.

Premium changes varied across the state, but on average were less in Southern California than Northern California.

The weighted average increase for Southern California consumers who stay in their current plan is 1.8 percent, while for consumers in Northern California it is 7 percent. Consumers in Southern California can save an average of nearly 10 percent by switching to a lower-cost plan in the same metal tier, while consumers in Northern California would potentially be able to limit their rate increase to an average of 1 percent if they did the same.

The size of the Covered California enrollment, nearly 1.4 million, has helped to limit premium increases, according to Lee. With this many enrollees, Covered California is a good risk mix and the “negotiating power of one of California’s biggest health-insurance purchases,” he added.

Of the total enrollees, more than a quarter live in Los Angeles County. Orange and San Diego counties follow and Riverside County, with 5 percent of enrollees, is fourth.

In 2016, more than 90 percent of hospitals (“general acute centers,” as designated by the California Office of Statewide Health Planning and Development) in California will be available through at least one health-insurance company, and now about three-quarters will be available through three or more companies.

The rates submitted by the selected companies are tentative and subject to a 60-day public comment period and independent reasonability review by the state’s regulators.

In the Inland Empire region, all consumers will have a choice of two insurance companies to choose from and some will have as many as five. For more details on the plans in specific pricing regions, read the booklet “Health Insurance Companies and Plan Rates for 2016,” posted online at www.CoveredCA.com/PDFs/7-27-CoveredCA-2016PlanRates-prelim.pdf.

Consumers will be able to shop around and look at their options during the upcoming renewal and open-enrollment period to decide whether to stay with their current plan or find another option that better suits their financial needs. Also, in most areas of the state, the federal subsidies given to enrollees to help reduce their overall costs will either increase or remain close to current levels and help offset any rate increase.

Covered California’s 2016 Shop and Compare Tool is available online at www.CoveredCA.com/shopandcompare/#calculator. Consumers will be able to look at plans and products in their area and get a preliminary estimate of costs and premium assistance for 2016 coverage.