The state budget, enacted in June, for the first time included nearly $400 million for an earned income tax credit for California residents. Last week, state officials announced availability, eligibility and how to obtain the credit. The state credit is in addition to the federal earned income tax credit.

Gov. Jerry Brown estimated than nearly 600,000 California families will be eligible for the credit.

California taxpayers can begin receiving the credit with filing of their 2015 income tax return on or before April 18, 2016.

Eligibility

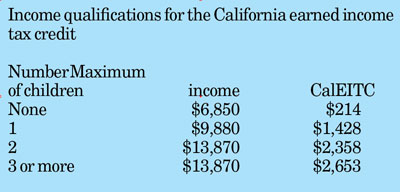

The first criterion is having income to report. The accompanying table provides the state tax credit for family sizes and income levels.

Other criteria include the following conditions:

• the filer must be between the ages of 25 and 65, unless they have a one or more qualifying children;

• the filer, spouse and all qualifying children each has to have a Social Security number;

• the tax return must be joint rather than “married/RDP filing separate” filing status; and

• the recipient must have lived in California for more than half the tax year.

More on eligilbity and how to calculate the possible credit can be found on the website, http://caleitc4me.org/earn-it.

Filing

Those who qualify for the EITC can file their taxes for free through the Volunteer Income Tax Assistance program, whose locations will be announced in early February.

If one wants to file their taxes from the comfort of home online, California offers a free-file online option at www.ftb.ca.gov/individuals/efile/allsoftware.shtml.

More information on free tax assistance in local communities will be announced in January 2016.

Californians who qualify for the state EITC also will likely qualify for the federal EITC. Both the state and federal credits will be available this tax season and may yield either a refund or reduce the amount of money owed. This will significantly boost household income for eligible families and individuals.

In 2013, more than 200,000 Riverside County residents claimed the federal EITC. Sixteen percent (233) of tax returns filed from zip code 92549 claimed the federal credit and nearly half relied on a paid tax preparer.

About 11 percent of local households reported income below $15,000. The availability of the state EITC should help 40,000 county residents.

State officials stressed that the earned income tax credits are not automatic. They must be claimed on tax returns.

Southern California Edison

Besides the state’s efforts to assist low-income families, SCE has a California Alternate Rates for Energy program. Depending on the size of the household and income level, electric rates may be reduced 30 percent. For example, one- or two-person families with income less than $31,860 would qualify.

Eligibility also is open if someone in the families qualifies for Medi-Cal, Medicaid, supplement security income or several other programs. The list is available at www.sce.com/wps/portal/home/residential/assistance/care-fera.

To apply, call 1-800-798-5723 or visit on.sce.com/CARE2015.