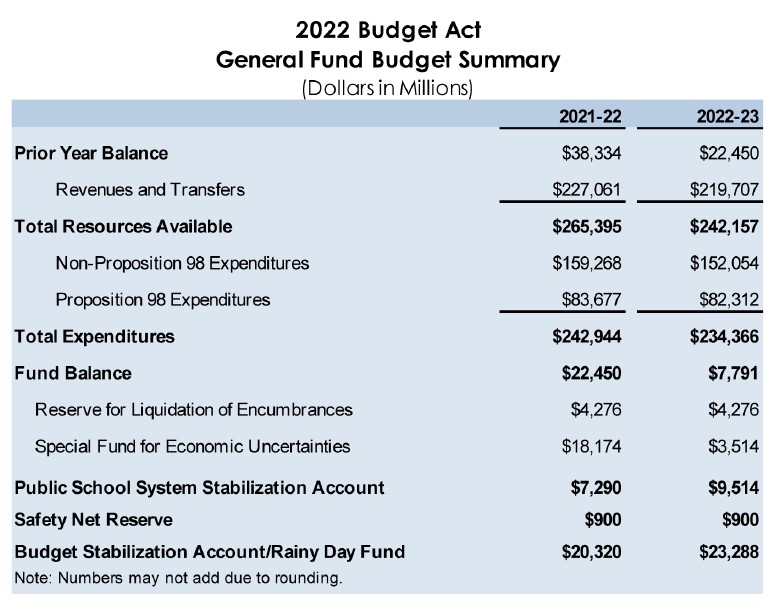

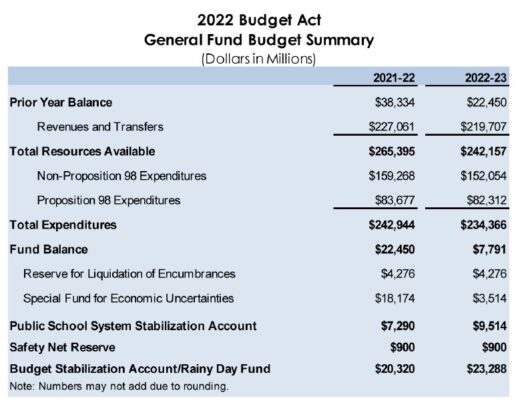

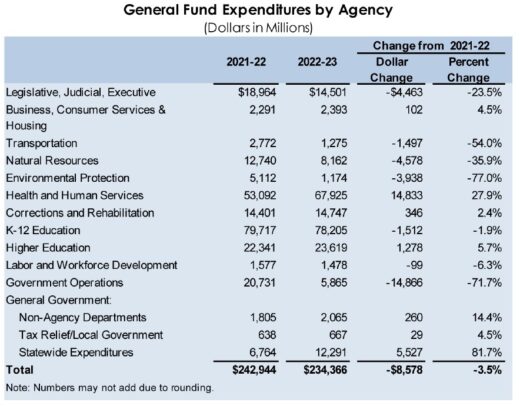

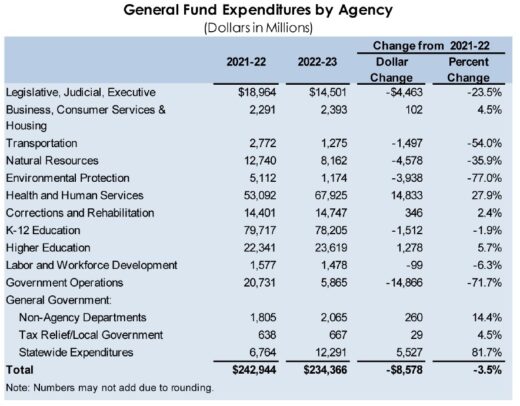

On June 30, Gov. Gavin Newsom signed the legislation enacting the fiscal 2022-2023 budget. The total state budget exceeds $300 billion, of which $234.4 billion is the General Fund. Submitted in January, Newsom’s initial proposed budget was for $286.5 million.

With the nation’s economic future still uncertain, the final budget includes $37.1 billion for reserves.

Earlier that day after the legislature’s actions, Senate President Pro Tempore Toni G. Atkins (D-San Diego) and Sen. Nancy Skinner (D-Berkeley), chair of the Senate Budget and Fiscal Review Committee, described the result of these budget negotiations: “With the budget the Senate passed today, we are putting our state’s wealth to work, providing $17 billion in relief for Californians facing higher prices at the gas pump and in the grocery store, and putting away record reserves for possible future downturns. Funding for important climate and wildfire efforts, schools, broadband, transportation, and other programs will benefit Californians for generations, as does our clear commitment to abortion rights and services in the aftermath of Roe — and beyond.”

Tax refunds

One of the most visible actions was the inclusion of $9.5 billion in tax refunds to help people with the consequences of inflation. Agreement between the governor and legislative leaders on how to address this issue was one of the final steps in securing the budget’s enactment.

“The centerpiece of the agreement, a $17 billion inflation relief package, will offer tax refunds to millions of working Californians. 23 million Californians will benefit from direct payments of up to $1,050,” Newsom, Atkins and Assembly Speaker Anthony Rendon (D-Lakewood) wrote in an earlier joint statement.

Three levels of refunds are based on the 2020 taxable California income and filing status (single, joint or with dependents). Single filers with income of $75,000 or less will receive $350 and another $350, for a total of $700, if they have dependents. Joint filers with income of $150,000 or less will receive $700, and another $350, for a total of $1,050 if they have dependents.

For single filers whose income is between $75,001 and $125,000 or joint filers with income between $150,001 and $250,000, the refund will be $250, or $500 if a joint return, and another $250 if they have dependents.

The refund level is $200 for single filers whose income is between $125,001 and $250,000 or $400 for joint filers with income between $250,000 and $500,000. Another $200 will be received if there are dependents for a potential total of $600.

According to the state Senate Floor Report, about 500,000 tax filers had income above the limit and will not receive any refund. For very low-income residents, who may not have had to file, the budget includes another $39 per month for those enrolled in the state’s Social Security Income Program.

Newsom’s initial plan would have provided rebate payments to vehicle owners. The legislative leaders’ preference was to make the payments based on income levels rather than car ownership, which would have favored higher-income residents. However, the initial proposal had lower-income limits, while still providing higher relief to lower-income families.

Gas taxes

While a significant cause of the current inflation rate is the dramatically rising gas prices, California’s excise tax on gasoline increased 2.8 cents on July 1, for a total of 53.9 cents per gallon. A 2.25% sales tax also applies to the purchase of gasoline.

During the June 30 Senate action, efforts to postpone the increase were rejected without a vote. Later, Assembly Republican Leader James Gallagher (Yuba City) issued a statement, “This was our last opportunity to prevent a $500 million gas tax increase on Californians who currently pay the highest prices in the nation. The increase will add even more costs to California’s nearly $7-per-gallon-gasoline.”

Health programs and initiatives

The new budget also includes funds to provide health care to all immigrants regardless of age and $200 million for reproductive care — facilities and costs.

“This budget invests in our core values at a pivotal moment, safeguarding women’s right to choose, expanding health care access to all and supporting the most vulnerable among us while shoring up our future with funds to combat the climate crisis, bolster our energy grid, transform our schools and protect communities,” Newsom said in the press release announcing his budget signing.

Rent help

Funding for emergency rental assistance and to help on past due utility bills is part of the budget compromises. Qualified low-income tenants had a March 31 deadline to request assistance. California’s program is the largest unified emergency rental assistance program in the nation, covering about 64% of the state’s population, with local emergency rental assistance programs covering the rest.

“California ran the largest and most successful eviction protection and rent relief program in the country,” said Newsom in a press release about the budget. “340,000 families weren’t evicted because of this and the overwhelming majority of assistance went to very low-income households. Homelessness prevented, public health protected, families stabilized.”

Water projects and fire protection

Water supply and fire protection are also important budget components. Nearly $5.5 billion was allocated to these efforts.

The Department of Water Resources received millions for water supply projects, drought relief, conservation for water suppliers and turf replacement.

Cal Fire received $96 million to acquire four new S70 Fire Hawk helicopters, $38.6 million for bulldozers and engines, and $37.8 million for more full-time staffing, more than $100 million for nearly 24 more hand crews for vegetation management, hazardous fuel reduction projects and wildland fire suppression, and $3.5 million to establish the Office of Wildfire Technology Research and Development.

Emergency power

Also, $3.4 billion was budgeted for energy projects and programs, including trailer bill language to help ensure backup electricity during emergencies.

“Drought is causing lower energy production. Extreme heat is causing increased energy demand. Wildfires threaten energy infrastructure,” Newsom stated in his press release. “So, we’re investing $4.3 billion to help keep the lights on this summer, invest in clean and reliable energy infrastructure, help with your energy bills, accelerate our transition to clean energy and so much more. We’re building the energy system of the future.”

This includes $140 million to support long-duration energy storage projects and $550 million for distributed electricity back up assets.

Education

Funding for education programs continues to reach record levels. Funding for local school districts is a 15% increase over the 2021-2022 funding levels, a record for ongoing discretionary base funding. Also, the budget language protects districts facing declining enrollment. These steps and a $9.5 billion Prop 98 Reserve should alleviate fears of a fiscal cliff or other budget concerns for school districts, according to the Senate’s report.

Summary of fiscal year 2022-2023 budget package

In their joint statement, Newsom, Atkins and Rendon summarized the new budget, “This budget builds on our unprecedented commitment to transform the resources available in our state, from a $47 billion multi-year infrastructure and transportation package to education and health care, showing the nation what a true anti-abortion agenda looks like. With these new investments, California will become the first state to achieve universal access to health care coverage … In the face of growing economic uncertainty, this budget invests in California’s values while further filling the state’s budget reserves and building in triggers for future state spending to ensure budget stability for years to come.”