In May, the Legislative Analyst’s Office (LAO) expressed pessimism about the state’s revenue projections for fiscal year (FY) 2023-24. And this month, Legislative Analyst Gabriel Petek confirmed that the state “faces a serious deficit” approaching $68 billion.

The state’s revenue was affected by several different economic conditions and problems.

As inflation grew in late 2021 and through 2022, the Federal Reserve began raising interest rates. California’s economy is quite dependent on interest rates being lower than average. The higher rates damaged the state’s economy in several different ways.

For example, as rates rose, the housing market fell. The LAO reported “… home sales are down by about half.” Sales tax revenue has been essentially flat despite rising prices.

The higher rates also affected the state’s ability to expand job markets. According to the LAO, “… investment in California startups and technology companies is especially sensitive to financial conditions and, as a result, has dropped significantly. For example, the number of California companies that went public (sold stock to public investors for the first time) in 2022 and 2023 is down over 80 percent from 2021.”

The consequence is that California’s unemployment has risen by 200,000 in the past 18 months, according to the LAO.

The negative consequences of the economy’s health and their effect on state revenue are normally identifiable at the end of a FY. This enables the Legislature to initiate actions to address the potential deficit.

California’s income tax revenue is dependent on residents’ federal income tax payments of which the governor and Legislature usually have a good estimate in June. However, the normal April 15 tax deadline was postponed until November in most California counties because of the 2023 winter storms and flooding. The state deferred tax payments consistent with the federal action.

Consequently, the FY 2022-23 tax revenue totals were not available until November. Tax receipts were $26 billion below estimates, down 25%.

“Had the Legislature had complete information about 2022-23 tax collections in May, as would be typical, it would have solved much of this deficit in June 2023. At that time, the Legislature would have had more options available to reduce spending,” Petek said in his report.

While these help explain the short-term causes of the this large projected deficit, one should be aware that state spending per capita has grown by a factor of 20 in the past 50 years and more than 2.5 times in the past 20 years.

This month, the LAO estimates the state will face a deficit of $68 million in FY 2024-25. The are many actions that the Legislature and governor could take to reduce and to address the deficit.

Among these are to use the “Rainy Day” balance that is now about $24 billion. Spending for schools and community colleges could be reduced by $17 billion and eliminating project one-time spending would save about another $10 billion.

However, the lower revenue could persist for several years and additional spending reductions and potential tax increases may be needed sooner. Also, taking all those actions now will reduce future flexibility.

Gov. Gavin Newsom has not taken any action yet, but his FY 2024-25 budget will be presented to the Legislature in January. Nevertheless, the Republican Caucus wrote Newsom Dec. 14 asking him to call a special session to address the state’s deteriorating financial condition.

“This situation is complicated by the fact that nearly half of the estimated deficit applies to a fiscal year that has already ended, which means that the lion’s share of available budget solutions will be confined to, and have an outsized impact, on the current and budget years,” wrote Assembly Republicans James Gallagher, Republican leader, and Vince Fong, vice chair of the Assembly Budget Committee.

“Urgent action now is necessary to roll back one-time and limited-term spending programs in the current year. Californians cannot risk more financial uncertainty, so immediate action now will help maximize the effect of current year solutions, and hopefully avoid the need for more difficult solutions later. The time to act is now,” they concluded.

Senate President Pro Tempore Toni G. Atkins (D-San Diego) released the following statement regarding the state’s predicament. “The LAO’s Fiscal Outlook includes challenging news — we can withstand this, but we will need to be cautious and mindful as we approach our budgeting and legislation next year and in the years to come.”

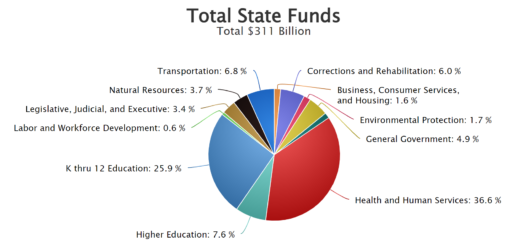

But Republican Senate Leader Brian W. Jones (San Diego) responded, “During my first budget cycle as an Assemblymember in 2011-2012, California operated with a $143 billion budget. Fast forward to the 2023-2024 budget cycle, Democrats’ spending soared the budget to a staggering $311 billion! In a mere decade, our state’s budget has more than doubled in size, an exponential surge, while the financial capabilities of Californians certainly haven’t undergone such a monumental increase as many struggle to afford to even stay in the state.”