By Flavia Mangan Colgan

Contributor

Flavia Mangan Colgan is a former political commentator and news

correspondent who works as a writer and in the nonprofit sector. She

lives in Idyllwild and San Diego.

Corporate influence on the single-family home market is growing at a

disturbing rate and is a nefarious problem that deserves more scrutiny.

Institutional investors have advantages over individual purchasers, such

as the ability to make cash offers above the asking price and the use of

greater computing power to make offers moments after a home hits the

market. Prices for single-family homes are skyrocketing, and individual

home buyers are being outbid by cash-only offers from corporate

investors.

Nationwide, real estate investors bought 18 percent of all single-family

homes in the U.S. in the fourth quarter of 2021. What happens is these

investors then turn a profit by creating thousands of new rental

properties, and decreasing supply of single-family homes erodes

communities by creating transient neighborhoods occupied primarily by

renters. It is common sense that when the tie between tenant, landlord

and community becomes a transaction between a faceless entity and one of

its many clients, the sense of community decays.

Institutional investors are targeting lower-priced fixer-upper homes,

competing with many first-time home buyers. I almost get calls from such

entities to make offers to purchase our cabin here, I am sure I am not

alone in this. The result when they pick up homes is that more

prospective new homeowners get squeezed out of home ownership and back

into the rental market they were trying to escape. This has occurred

repeatedly in the last decade, yielding a massive transfer of wealth

from the middle class to the top 1 percent.

The fear is that corporate control of huge segments of rental markets in

our region will lead to the same problems that have plagued other such

properties, namely increased evictions, increased rents, and worsening

customer service.

California’s shortfall of several hundred thousand residential home

units has also contributed to rising home prices. We are left with a

market characterized by dwindling supply and increasing corporate

influence. How do we advocate for the average citizen looking to break

into an impenetrable market? The goal is to give the individual a

helping hand against corporate interests and also tackle the demand

side.

At the federal level, Rep. Adam Smith, D-Washington, has introduced the

End Hedge Fund Control of American Homes Act, which would mandate that

hedge funds sell off all single-family homes over a ten-year period, and

eventually prevent them from holding these properties completely. In

California, the Legislature passed Assembly Bill 2011 and Senate Bill 6

designed to address housing supply, bills which Senate President pro

Tempore Emeritus Toni Atkins, D-San Diego, said “will result in both the

affordable and market-rate housing that our state desperately need.”

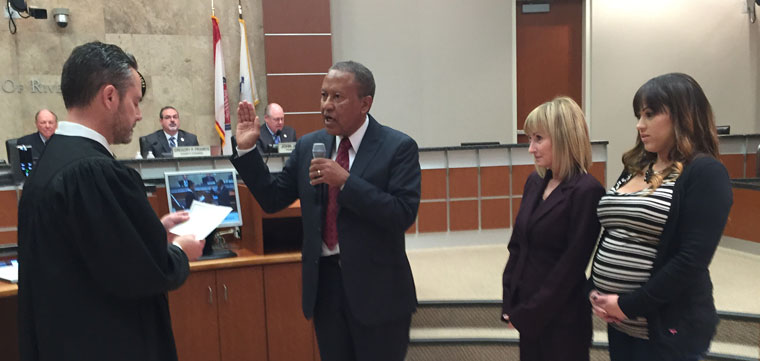

Will Rollins, a candidate in our CA-41 congressional district has

pledged to “lower housing costs by going after corporate investors who

are buying up homes.”

The availability of single-family homes to individual buyers is a

fundamental equality issue and key to maintaining the American dream for

all citizens. We ignore the issue of growing inequality in the housing

market at great peril. If the ability of large swaths of society to own

a home is compromised, they are shut out of upward mobility. The great

tensions that we see in our society are exacerbated in times of such

extreme inequality. As the late U.S. Supreme Court Justice Louis

Brandeis once said: “We may have democracy, or we may have wealth

concentrated in the hands of the few, but we cannot have both.”